The Critical Role of Loan Forgiveness in Rejuvenating the U.S. Economy

In America, financial obligations can burden citizens and hinder economic growth. Loan forgiveness presents a potential solution, offering a chance to stimulate the economy.

The Albatross of Debt

What impact does outstanding debt have on the economy? The staggering amount of student loan debt, exceeding $1.7 trillion, weighs heavily on millions. This debt limits consumer spending, homeownership, and entrepreneurship. As a result, it poses a significant challenge to economic growth.

The Ripple Effect

How does this debt influence individual decisions? Borrowers often delay important life choices—such as buying homes or starting businesses—due to their student loan burdens. This reluctance reduces consumer spending, which can slow down employment rates and wage growth. A weaker consumer base leads to stunted economic activity.

Unleashing Economic Potential

Could loan forgiveness be the key to economic recovery? Forgiving a portion of student debt can liberate consumers and entrepreneurs. With reduced financial burdens, individuals can invest in homes and businesses, revitalizing the housing market and job creation.

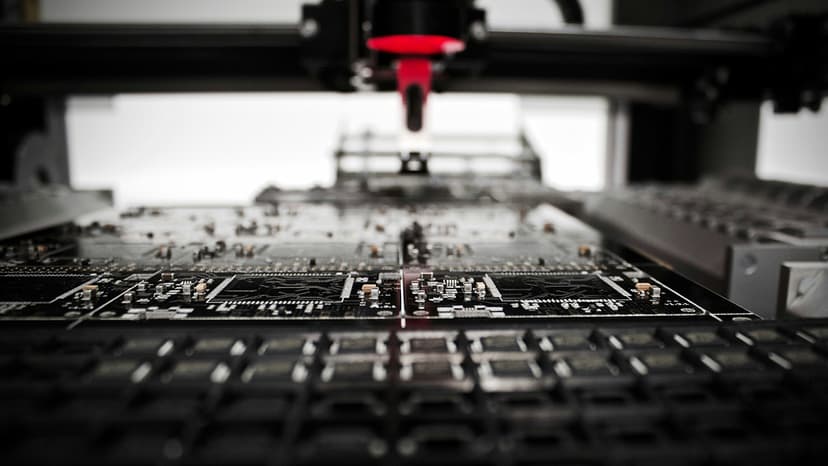

Freed from heavy loan payments, innovators can pursue new ventures. This could lay the groundwork for emerging industries and technologies.

Real People, Real Stories

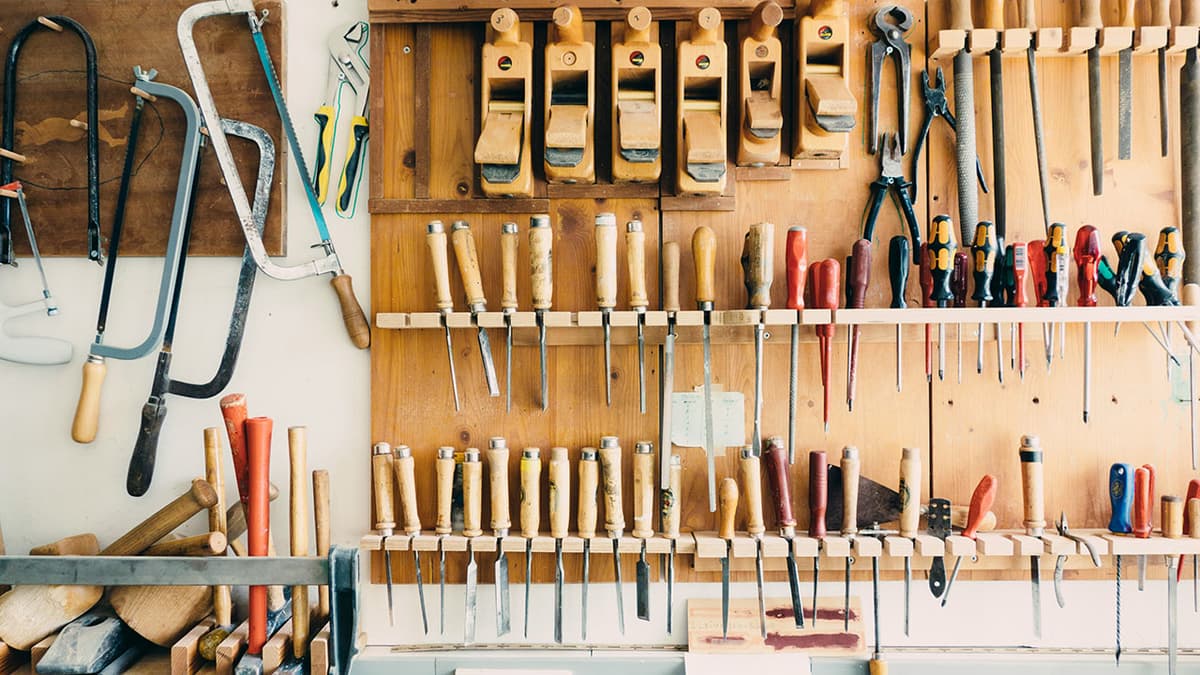

What would loan forgiveness mean for individuals? Take Rachel, a recent college graduate with $30,000 in student loans. With forgiveness, she could shift from being cautious with her finances to actively engaging in the economy, perhaps starting her own graphic design business.

Consider James, a veteran teacher with similar debt. Eliminating his loans would allow him to upgrade his home, stimulating the local real estate market and benefiting businesses in his community.

A Tipping Point

Are we approaching a crucial moment for economic policy? Widespread loan forgiveness could significantly reshape the economy. This approach should be viewed not as a giveaway but as an investment in the future. The history of interventions like the GI Bill demonstrates how strategic support can lead to lasting economic benefits.

A Balancing Act

How can policymakers ensure effective loan forgiveness? While concerns about moral hazard and taxpayer burden exist, targeted approaches can benefit those most in need. By focusing on individuals with the greatest constraints, these measures can spark widespread economic activity.

What does this mean for taxpayers? The potential for higher tax revenues through increased incomes and consumer demand could offset initial costs, contributing to a more stable economy.

The Path Forward

Is loan forgiveness key to financial freedom? It serves as a powerful tool to unlock the potential of millions burdened by debt, transforming them into contributors to economic growth.

Taking steps towards financial freedom today could pave the way for prosperity for all. A proactive approach can leave a lasting impact on the nation’s economic future.

(Edited on September 4, 2024)