Money Matters: Savings Milestone by 30

Talking about money can feel awkward, but planning for your future is important. By the time you reach 30, you may have experienced various life events, such as starting a career, attending college, or raising a family. These milestones can significantly impact your finances. How much money should you have saved by the age of 30?

Making Sense of Savings

First, it's commendable to think about saving. It's the foundation of financial independence and security. However, determining a specific number can be challenging. Personal finance is unique to each individual, and what constitutes a comfortable savings amount can vary widely.

Traditionally, some experts recommend saving the equivalent of your annual salary by 30. Others suggest aiming for a range between half to a full year’s salary. These figures are decent benchmarks, but your personal circumstances, such as career, lifestyle, and financial obligations, will greatly influence your ideal savings target.

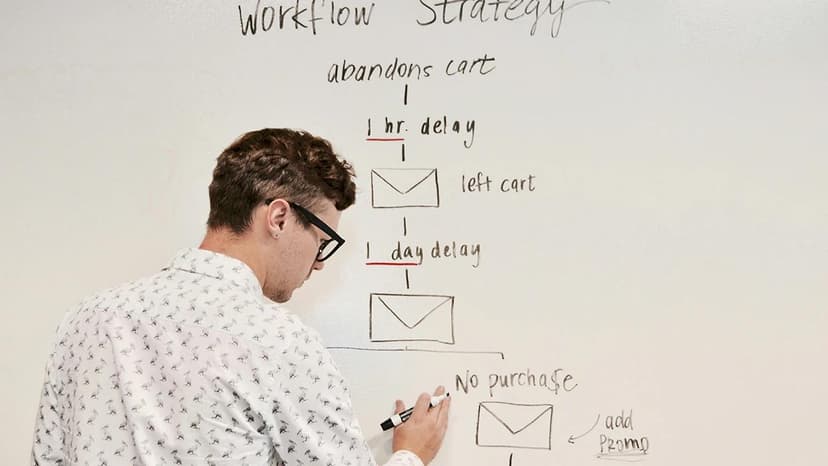

Setting Your Savings Goals

What are your savings goals? Establishing savings goals should balance practicality with aspiration. A popular starting point is the 50/30/20 rule. This framework suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings. Consistently saving 20% of your income in your twenties can help you reach that annual salary milestone.

Emergency Fund First

Before accumulating large sums of cash, prioritize building an emergency fund. Life can be unpredictable, and an emergency fund serves as your safety net. Aim to save three to six months' worth of living expenses in an easily accessible account, such as a savings account.

Retirement Planning

When should you start planning for retirement? The sooner, the better. If your job offers a retirement plan, like a 401(k), take advantage of it, especially if they match contributions. If a 401(k) is not available, consider opening an Individual Retirement Account (IRA) to start saving for your future.

Paying Down Debt

What should you focus on if you have debt? Prioritize paying down high-interest debt, such as credit cards. Reducing debt can be more beneficial than saving because avoiding interest payments often outweighs the interest you would earn on savings.

Think Percentages, Not Just Dollars

Why should you focus on percentages? Using percentages rather than fixed amounts can make savings more manageable. As your income increases, the amount you save should grow as well, keeping pace with your lifestyle changes.

Lifestyle Considerations

How do lifestyle choices affect your savings goals? If you live in a city with a high cost of living, your savings targets may differ from someone in a more affordable area. Expenses such as rent, food, and transportation can vary significantly, impacting your ability to save.

Adjusting As You Go

Why is it essential to adjust your savings strategy? Your twenties are a time of change, and your savings plan should be flexible. Regularly reassessing and adjusting your goals as your life circumstances evolve is vital. A raise might mean it's time to save more, while unexpected expenses may require a reassessment of your current goals.

Staying on top of your savings is crucial. Consistent effort, even in small amounts, will lead to significant progress over time.

How much should you have saved by 30? While there is no universal answer, a good goal includes having a robust emergency fund, no high-interest debt, and a growing retirement account. It's important to develop a financial cushion tailored to your life rather than chasing arbitrary numbers.

Begin where you are and do what you can. The journey to financial security is a gradual process. Start saving today for your future.